Prequalification vs. Preapproval: What’s the Difference When Buying a Home?

The homebuying process can feel like a maze, and two terms that often trip up buyers are “prequalification” and “preapproval.” While they sound similar, they play very different roles on your path to homeownership. Let’s break down what each means and why it matters for your journey.

What is a Prequalification Letter?

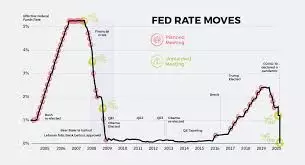

Think of prequalification as dipping your toe into the water. It’s a quick and easy way to get a rough idea of how much you might be able to borrow. You share basic details about your income, debts, and assets—usually online or over the phone—and the lender gives you an estimate. There’s no deep dive into your finances, and your credit isn’t typically checked.

- Speedy and simple: You can often get prequalified in just a few minutes.

- No obligation: It’s a casual step—no paperwork or hard credit pulls.

- Limited power: Sellers know it’s just an estimate, so it won’t make your offer stand out in a competitive market.

What is a Preapproval Letter?

Preapproval is a bigger commitment. Here, the lender takes a close look at your financial life: pay stubs, bank statements, credit report, and more. This process gives you (and sellers) a much clearer picture of what you can truly afford.

- Thorough process: Expect to provide documentation and go through a credit check.

- Stronger offer: Sellers see you as a serious, qualified buyer—sometimes as good as cash!

- Valid for a limited time: Preapproval letters usually last 60–90 days, so timing matters.

Why Does It Matter?

In today’s real estate market, being preapproved can be your secret weapon. If you find your dream home and want to make an offer, a preapproval letter signals to the seller that you’re ready and able to buy. In contrast, a prequalification letter is more like raising your hand to say you’re interested—but not quite ready to commit.

A Quick Analogy

Imagine you’re at a car dealership. Prequalification is like browsing the lot with an idea of your budget. Preapproval is walking in with a check in hand, ready to drive away in your new ride.

Which Should You Get?

If you’re early in your search, prequalification is a great way to start. But when you’re ready to shop seriously and make offers, preapproval will help you stand out from the crowd.

Need guidance on getting preapproved or want a checklist of what documents you’ll need? Reach out—I’m here to help you every step of the way!

Categories

Recent Posts