7 Simple Habits to Boost Your Credit Score—Starting Today!

Improving your credit score might sound daunting, but it’s often about making small, consistent choices that add up over time. Think of it like tending to a garden—daily care leads to flourishing results. Here are seven simple habits you can start today to give your credit score a healthy boost:

- Pay Bills on Time

Set up reminders or automatic payments so you never miss a due date. Payment history makes up a significant portion of your credit score, so consistency here is key. - Keep Credit Card Balances Low

Aim to use less than 30% of your available credit. If your limit is $1,000, try to keep your balance below $300. This shows lenders you’re responsible with credit. - Don’t Open Too Many Accounts at Once

Every time you apply for new credit, it can cause a small dip in your score. Only apply for what you truly need, and space out applications over time. - Check Your Credit Report Regularly

Errors happen! Review your credit reports at least once a year to spot mistakes or suspicious activity. You can dispute errors and have them corrected. - Pay Off Debt Strategically

Focus on paying down high-interest debts first, but make sure to pay at least the minimum on all accounts. This reduces your overall debt and helps your score. - Keep Old Accounts Open

The length of your credit history matters. If you have old credit cards with no annual fee, consider keeping them open to show a longer, positive history. - Limit Hard Inquiries

Hard inquiries—like when you apply for a loan or new card—can temporarily lower your score. Avoid unnecessary credit checks when possible.

Building a better credit score doesn’t require drastic changes, just smart, steady habits. With these steps, you’ll be on your way to a stronger financial future—one good choice at a time!

Categories

Recent Posts

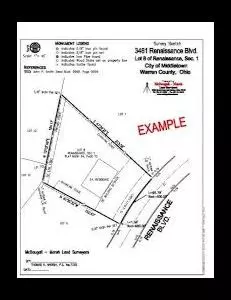

What Is the Purpose of a Real Estate Survey?

7 Simple Habits to Boost Your Credit Score—Starting Today!

Considering a Move to Tinley Park, IL? Here’s What You Should Know

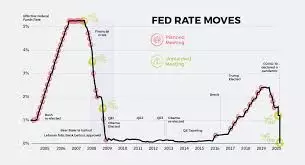

What Is an APR on an Interest Rate?

When Should You Start Preparing to Buy a Home for the 2026 Real Estate Season?

Should I Rent Versus Purchase a Home?

Why Every Homeowner Should Care About Vapor Barriers in Crawlspaces

Why Oak Forest, Illinois is a Great Place to Buy a Home

Is Title Insurance Necessary?

A Guide to Moving to Lockport, Illinois